W9 Tax Form

Get NowW9 Tax Form: An Ultimate Guide for Contractors and Businesses

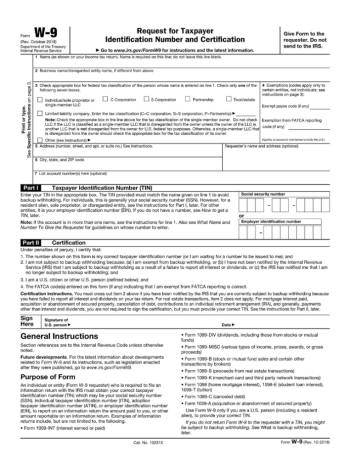

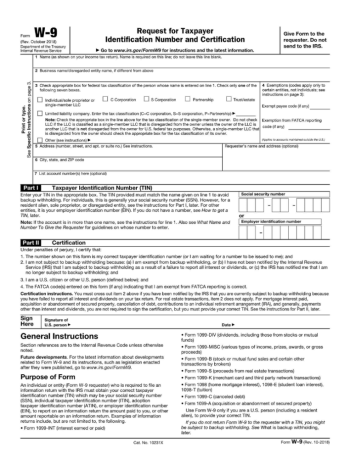

Form W9 is a crucial document used by US taxpayers, employers, and financial institutions to gather crucial tax information from independent contractors, banks, and other entities. In this comprehensive guide, we will discuss the importance of the W9 tax form, recent changes to the sample, eligibility criteria, and tips for utilizing it effectively.

A Handy Guide to Form W9: What You Need to Know

Form W9, also known as the Request for Taxpayer Identification Number and Certification, is a fundamental IRS document that helps obtain tax-related details from individuals and organizations required to file an information return. Think of this as a bridge between taxpayers and the IRS, allowing the latter to estimate tax liabilities accurately.

Stay Updated With the Latest Changes to the Form

While the W9 tax form remains largely consistent, the IRS occasionally introduces new versions to accommodate changing US laws and regulations. By using the latest printable W9 form for 2023, you can ensure that you stay up-to-date with the most current revisions, adding accuracy and credibility to your tax filings.

Who Should Use the W9 Tax Form

- Eligible taxpayers: Independent contractors, freelancers, and vendors who provide services to clients in the US are primarily required to complete the IRS W9 form. Financial institutions also use this sample to verify US resident account holders' tax identification numbers and claim exemptions from withholding on their income.

- Ineligible taxpayers: Non-US residents should avoid using the W9 tax form, as they may have to fill out the W-8 sample instead. Similarly, employees who receive wages should not use the free W9 online template since they are required to complete the W-4 sample for their employers.

Maximize the Benefits of W9 Forms with These Easy Tips

When filing the blank request, keep in mind that accuracy and compliance with IRS guidelines are essential. Here are some useful suggestions that will help you optimize the advantages of using Form W9:

- Go Digital

Instead of searching for a blank W9 form PDF to print out, head online and use the fillable template. This makes filling, editing, and submitting electronically easy, ensuring a secure and error-free process. - Stay Organized

Keep track of all the W9 copies you've submitted or received from payees or clients. Organizing your documents will make reporting income, expenses, and other financial information easier when it's time to file your annual return. - Understand Withholding Rules

You can avoid excessive withholding by accurately completing the printable W9 example. For instance, independent contractors who generally pay their taxes through the Self-Employment Tax can benefit from reduced withholding by correctly filing their W9 copies.

Armed with the right information and careful approach, the federal W9 form doesn't have to be overwhelming. By understanding the significance and function of the request, utilizing the latest printable template, and following the eligibility guidelines, you can make the most of the W9 tax form and stay compliant with the IRS.

Related Forms

-

![image]() W-9 The IRS Form W-9 is a vital document that plays a significant role in federal taxation every fiscal year. The request is specifically designed to collect essential information from independent contractors and other non-employee individuals who provide services to businesses in the United States. The collected data include taxpayer identification numbers (TIN), names, and addresses from service providers, thereby allowing businesses to accurately report financial transactions to the Internal Reve... Fill Now

W-9 The IRS Form W-9 is a vital document that plays a significant role in federal taxation every fiscal year. The request is specifically designed to collect essential information from independent contractors and other non-employee individuals who provide services to businesses in the United States. The collected data include taxpayer identification numbers (TIN), names, and addresses from service providers, thereby allowing businesses to accurately report financial transactions to the Internal Reve... Fill Now -

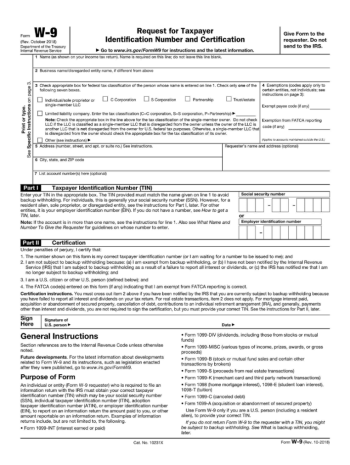

![image]() IRS W-9 Form Instructions Taxes can be daunting, especially when you're bombarded with a myriad of tax documents and instructions. If you have been requested to fill out a W-9 form or are curious about its purpose, you've come to the right place. In this article, we will discuss the necessity of this request, its key elements, and common mistakes people make when dealing with it. When is IRS Form W-9 Necessary or Optional? The primary purpose of IRS Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, is for individuals and entities to provide their taxpayer identification number (TIN), which is usually their Social Security Number (SSN) or Employer Identification Number (EIN), to the requester. This document is typically used by independent contractors, freelancers, or businesses providing services to other businesses. W9 form instructions are provided by the requester, such as an employer or financial institution, to ensure that they report accurate income and backup withholding taxes to the IRS. Key Elements to Consider Regarding Form W-9 Provide accurate and up-to-date personal information, including your full legal name, address, and tax classification. Enter your TIN, either an SSN or an EIN, depending on your taxpayer status. If required, include backup withholding status or any exemptions you may have. Ensure you sign and date the document. A digital signature may be acceptable, depending on the requesting party. Stay diligent with IRS W-9 form instructions to maintain compliance and avoid any penalties or issues with the IRS. Common Mistakes and How to Avoid Them Even though the W-9 form is relatively straightforward, it's easy to make mistakes. Here are some common errors and how to steer clear of them by following instructions for the W9 tax form: Providing an incorrect TINSolution: Triple-check your SSN or EIN before submitting the request. Using an informal name or an outdated addressSolution: Double-check that you have used your full legal name and current address when filling out the template. Forgetting to sign and date the sampleSolution: Before submitting the copy, make sure you have signed and dated it in the required section. Not submitting the request in a timely mannerSolution: Abide by the requester's deadline for submitting the W-9 copy to avoid any issues. IRS Form W-9 is a vital component of tax compliance for independent contractors and businesses providing services to other businesses. Understanding its purpose, key elements, as well as common mistakes can help ensure you complete and submit the form accurately and on time. Keeping up-to-date with W-9 form instructions will not only make your tax filing process smoother but also help you avoid unnecessary penalties or issues with the IRS. Fill Now

IRS W-9 Form Instructions Taxes can be daunting, especially when you're bombarded with a myriad of tax documents and instructions. If you have been requested to fill out a W-9 form or are curious about its purpose, you've come to the right place. In this article, we will discuss the necessity of this request, its key elements, and common mistakes people make when dealing with it. When is IRS Form W-9 Necessary or Optional? The primary purpose of IRS Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, is for individuals and entities to provide their taxpayer identification number (TIN), which is usually their Social Security Number (SSN) or Employer Identification Number (EIN), to the requester. This document is typically used by independent contractors, freelancers, or businesses providing services to other businesses. W9 form instructions are provided by the requester, such as an employer or financial institution, to ensure that they report accurate income and backup withholding taxes to the IRS. Key Elements to Consider Regarding Form W-9 Provide accurate and up-to-date personal information, including your full legal name, address, and tax classification. Enter your TIN, either an SSN or an EIN, depending on your taxpayer status. If required, include backup withholding status or any exemptions you may have. Ensure you sign and date the document. A digital signature may be acceptable, depending on the requesting party. Stay diligent with IRS W-9 form instructions to maintain compliance and avoid any penalties or issues with the IRS. Common Mistakes and How to Avoid Them Even though the W-9 form is relatively straightforward, it's easy to make mistakes. Here are some common errors and how to steer clear of them by following instructions for the W9 tax form: Providing an incorrect TINSolution: Triple-check your SSN or EIN before submitting the request. Using an informal name or an outdated addressSolution: Double-check that you have used your full legal name and current address when filling out the template. Forgetting to sign and date the sampleSolution: Before submitting the copy, make sure you have signed and dated it in the required section. Not submitting the request in a timely mannerSolution: Abide by the requester's deadline for submitting the W-9 copy to avoid any issues. IRS Form W-9 is a vital component of tax compliance for independent contractors and businesses providing services to other businesses. Understanding its purpose, key elements, as well as common mistakes can help ensure you complete and submit the form accurately and on time. Keeping up-to-date with W-9 form instructions will not only make your tax filing process smoother but also help you avoid unnecessary penalties or issues with the IRS. Fill Now -

![image]() Free W9 Online Form Form W-9 is a crucial document used by businesses, employers, and individuals in the United States. It serves as the request for the taxpayer's identification number and certification, which is necessary for various financial transactions. The IRS requires freelancers, independent contractors, and other entities to fill out W9 online and submit it to stay compliant with tax regulations. In this article, we will discuss the features of the free fillable W-9 form, common challenges faced during online submission, and useful recommendations for successfully completing the template. Embrace the Convenience of the W9 Fillable PDF Filling out the W9 online form for free saves time and resources while offering numerous benefits over the traditional paper-based version. Some of these advantages include instant accessibility, easy modification, and secure storage of your data. You can access the W-9 sample anytime, anywhere, and complete it at your convenience using a computer, tablet, or smartphone. The free fillable W-9 form allows you to enter your information directly into the required fields and ensures that your data is captured accurately. Additionally, most online platforms provide encryption and data protection, safeguarding your personal information from unauthorized access. Overcoming Hurdles in Online Form Submission As with any digital process, there may be certain difficulties when attempting to submit a free W9 online form. Common issues include technical errors such as interrupted internet connections, browser compatibility problems, or difficulties navigating the online platform. To ensure your online experience is smooth and stress-free, consider using a reliable internet connection and accessing the request using an up-to-date browser. Moreover, read the current instructions carefully and review the terms and conditions of the online platform to avoid any discrepancies later on. Tips for Successfully Filling Out Your W9 Form Successfully completing and submitting a W-9 form online involves careful attention to detail and proper planning. Here are some recommendations to help you: Verify your taxpayer identification number (TIN) before entering it in the form. It could be your Social Security Number (SSN) or Employer Identification Number (EIN) if you're operating as a business entity. Ensure that you provide accurate and complete information in all relevant fields to avoid delays in processing your document. Choose a secure and reputable online platform to fill out and store your W-9 form. Look for features such as encryption, multi-factor authentication, and secure storage. Always review your sample thoroughly before submitting it online. Double-check your data, correct any errors, and ensure you understand the certification requirements and penalties associated with false statements. Save a copy of the completed request for your records, and be ready to provide additional copies if requested by your clients or the IRS. The free online W-9 form simplifies the process of providing your taxpayer identification number and certification to various parties. Familiarize yourself with the fillable template's features and follow the recommendations above to complete and submit the form accurately and efficiently. Fill Now

Free W9 Online Form Form W-9 is a crucial document used by businesses, employers, and individuals in the United States. It serves as the request for the taxpayer's identification number and certification, which is necessary for various financial transactions. The IRS requires freelancers, independent contractors, and other entities to fill out W9 online and submit it to stay compliant with tax regulations. In this article, we will discuss the features of the free fillable W-9 form, common challenges faced during online submission, and useful recommendations for successfully completing the template. Embrace the Convenience of the W9 Fillable PDF Filling out the W9 online form for free saves time and resources while offering numerous benefits over the traditional paper-based version. Some of these advantages include instant accessibility, easy modification, and secure storage of your data. You can access the W-9 sample anytime, anywhere, and complete it at your convenience using a computer, tablet, or smartphone. The free fillable W-9 form allows you to enter your information directly into the required fields and ensures that your data is captured accurately. Additionally, most online platforms provide encryption and data protection, safeguarding your personal information from unauthorized access. Overcoming Hurdles in Online Form Submission As with any digital process, there may be certain difficulties when attempting to submit a free W9 online form. Common issues include technical errors such as interrupted internet connections, browser compatibility problems, or difficulties navigating the online platform. To ensure your online experience is smooth and stress-free, consider using a reliable internet connection and accessing the request using an up-to-date browser. Moreover, read the current instructions carefully and review the terms and conditions of the online platform to avoid any discrepancies later on. Tips for Successfully Filling Out Your W9 Form Successfully completing and submitting a W-9 form online involves careful attention to detail and proper planning. Here are some recommendations to help you: Verify your taxpayer identification number (TIN) before entering it in the form. It could be your Social Security Number (SSN) or Employer Identification Number (EIN) if you're operating as a business entity. Ensure that you provide accurate and complete information in all relevant fields to avoid delays in processing your document. Choose a secure and reputable online platform to fill out and store your W-9 form. Look for features such as encryption, multi-factor authentication, and secure storage. Always review your sample thoroughly before submitting it online. Double-check your data, correct any errors, and ensure you understand the certification requirements and penalties associated with false statements. Save a copy of the completed request for your records, and be ready to provide additional copies if requested by your clients or the IRS. The free online W-9 form simplifies the process of providing your taxpayer identification number and certification to various parties. Familiarize yourself with the fillable template's features and follow the recommendations above to complete and submit the form accurately and efficiently. Fill Now -

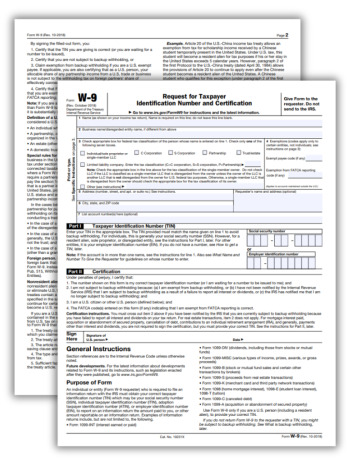

![image]() Free Blank W-9 Form The free W9 tax form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document for freelancers and self-employed individuals in the United States. This free printable W-9 form allows freelancers to provide their information such as Tax Identification Number (TIN) and taxpayer details to clients and employers. The form has a simple design with a few important sections that must be accurately completed. The main segments of the template include: Personal informationName, business name (if any), federal tax classification, and the exemption codes (if applicable) AddressStreet address, city, state, and zip code Identification numbersSocial security number (SSN) or employer identification number (EIN) CertificationSignature and date of signing to certify the provided information Guidelines for Filling Out IRS Form W-9 Accurately To ensure the free blank W-9 form is properly filled out, follow these guidelines: Use your legal name when filling in personal details, regardless of your business name. Write your taxpayer identification number accurately and check it twice. If you're not sure about your federal tax classification, consult with a tax professional for guidance. If you have updates to your exemption codes, consult the Internal Revenue Service (IRS) website. Remember to sign and date the certification section before submitting the example. Review the request before printing to avoid errors. Submitting the Completed Tax Form W-9 Once you have downloaded and completed the W9 form for free, follow these steps to properly submit the request: Finalize the review of your form, verifying all the provided information is accurate and complete. Now that the sample is properly filled, print the W9 form for free. Correctly sign and date the document. Prepare a digital copy of the completed request: either scan or take a clear photo using your smartphone or camera. Submit the signed sample to the requesting party – usually your client or employer. The request can be sent electronically, via email or a client’s document submission system, or physically, via mail or in-person drop-off. Keep an extra copy of the submitted document for your records in case of any discrepancies in the future. Due for the IRS W-9 Tax Form Submission When it comes to the deadline for submitting a Form W-9, there is no specific deadline provided by the IRS. Generally, you should submit the copy promptly once it's requested by the client or employer. This is essential because it allows your payer to issue the appropriate information returns to the IRS, such as 1099 return, on time. The faster you submit the W-9 form, the sooner you can be accredited for the payments received and minimize the risk of tax complications. Understanding the structure of the template, accurately completing it, and promptly submitting it plays a significant role in ensuring your tax compliance as a freelancer. Download the W9 form for free and follow the steps provided in this guide to seamlessly complete and submit your request. Fill Now

Free Blank W-9 Form The free W9 tax form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document for freelancers and self-employed individuals in the United States. This free printable W-9 form allows freelancers to provide their information such as Tax Identification Number (TIN) and taxpayer details to clients and employers. The form has a simple design with a few important sections that must be accurately completed. The main segments of the template include: Personal informationName, business name (if any), federal tax classification, and the exemption codes (if applicable) AddressStreet address, city, state, and zip code Identification numbersSocial security number (SSN) or employer identification number (EIN) CertificationSignature and date of signing to certify the provided information Guidelines for Filling Out IRS Form W-9 Accurately To ensure the free blank W-9 form is properly filled out, follow these guidelines: Use your legal name when filling in personal details, regardless of your business name. Write your taxpayer identification number accurately and check it twice. If you're not sure about your federal tax classification, consult with a tax professional for guidance. If you have updates to your exemption codes, consult the Internal Revenue Service (IRS) website. Remember to sign and date the certification section before submitting the example. Review the request before printing to avoid errors. Submitting the Completed Tax Form W-9 Once you have downloaded and completed the W9 form for free, follow these steps to properly submit the request: Finalize the review of your form, verifying all the provided information is accurate and complete. Now that the sample is properly filled, print the W9 form for free. Correctly sign and date the document. Prepare a digital copy of the completed request: either scan or take a clear photo using your smartphone or camera. Submit the signed sample to the requesting party – usually your client or employer. The request can be sent electronically, via email or a client’s document submission system, or physically, via mail or in-person drop-off. Keep an extra copy of the submitted document for your records in case of any discrepancies in the future. Due for the IRS W-9 Tax Form Submission When it comes to the deadline for submitting a Form W-9, there is no specific deadline provided by the IRS. Generally, you should submit the copy promptly once it's requested by the client or employer. This is essential because it allows your payer to issue the appropriate information returns to the IRS, such as 1099 return, on time. The faster you submit the W-9 form, the sooner you can be accredited for the payments received and minimize the risk of tax complications. Understanding the structure of the template, accurately completing it, and promptly submitting it plays a significant role in ensuring your tax compliance as a freelancer. Download the W9 form for free and follow the steps provided in this guide to seamlessly complete and submit your request. Fill Now -

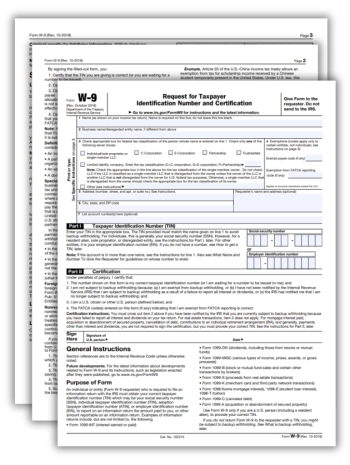

![image]() Download W-9 Tax Form Welcome to the world of taxes, my fellows! Let's dive in and talk about the infamous Form W-9. You might think this document is just for the basic tax filer, but it can also apply in some pretty unusual circumstances. Today, we'll explore some of these situations and provide solutions for each while making sure you can easily handle any hurdles that come your way. Atypical Examples and Solutions for Filing Form W-9 Non-U.S. Citizens with U.S. IncomeIf you're a non-U.S. citizen living abroad but receiving income from a U.S. based company, you may need to submit a downloadable W-9 form. To avoid backup withholding, make sure to provide the U.S. company with your foreign taxpayer identification number (TIN). It's also essential to prove you qualify for an exemption under an international tax treaty Deceased Family Members with IncomeIf you're the executor of a deceased family member's estate, you may need to download a W-9 tax form for the deceased. In this case, you would provide the deceased person's Social Security Number and name. Additionally, you should attach a statement to the request clarifying that you are filing on behalf of a deceased individual. U.S. Citizens Earning Income Through Foreign CorporationsIf you're a U.S. citizen operating through a foreign corporation and earning income, you might need IRS Form W-9 for download to fill out and file. You'll need to provide the foreign corporation's EIN and your personal taxpayer identification number to avoid any confusion in reporting. Resolving Errors in IRS W-9 Form Submission Errors on the request can create some issues, but fear not! We've put together a go-to guide for fixing these mistakes: Incorrect TINIf you accidentally provided the incorrect taxpayer identification number on your template, reach out to the requester and supply them with the correct TIN. You may need to submit a revised example with accurate information. Incorrect Other DetailsIn cases where you provided inaccurate information other than the TIN, resubmitting a corrected W-9 form for 2023 to download is the way to go. Ensure the updated details are correct before submitting the new copy. Backup WithholdingIf the IRS initiates backup withholding due to an error on your request, you must correct the mistake and inform the requester. To stop backup withholding, provide the requester with a properly completed example and any necessary certifications. Practical Questions on the W-9 Form Answered Where can I find a W-9 form online?You can conveniently download the W9 form for free from our website. Be sure to use the current year's version for compliance. How do I submit a W-9 form?If a business or individual requests a W-9 form from you, they'll typically provide instructions on how and where to submit the completed sample. This can include mailing, faxing, or emailing the copy. Are W-9 forms sent to the IRS?Generally, W-9 forms are not sent to the IRS. The requester keeps them for their records. Payers use these forms to complete informational returns, such as Form 1099, which are then submitted to the IRS. Fill Now

Download W-9 Tax Form Welcome to the world of taxes, my fellows! Let's dive in and talk about the infamous Form W-9. You might think this document is just for the basic tax filer, but it can also apply in some pretty unusual circumstances. Today, we'll explore some of these situations and provide solutions for each while making sure you can easily handle any hurdles that come your way. Atypical Examples and Solutions for Filing Form W-9 Non-U.S. Citizens with U.S. IncomeIf you're a non-U.S. citizen living abroad but receiving income from a U.S. based company, you may need to submit a downloadable W-9 form. To avoid backup withholding, make sure to provide the U.S. company with your foreign taxpayer identification number (TIN). It's also essential to prove you qualify for an exemption under an international tax treaty Deceased Family Members with IncomeIf you're the executor of a deceased family member's estate, you may need to download a W-9 tax form for the deceased. In this case, you would provide the deceased person's Social Security Number and name. Additionally, you should attach a statement to the request clarifying that you are filing on behalf of a deceased individual. U.S. Citizens Earning Income Through Foreign CorporationsIf you're a U.S. citizen operating through a foreign corporation and earning income, you might need IRS Form W-9 for download to fill out and file. You'll need to provide the foreign corporation's EIN and your personal taxpayer identification number to avoid any confusion in reporting. Resolving Errors in IRS W-9 Form Submission Errors on the request can create some issues, but fear not! We've put together a go-to guide for fixing these mistakes: Incorrect TINIf you accidentally provided the incorrect taxpayer identification number on your template, reach out to the requester and supply them with the correct TIN. You may need to submit a revised example with accurate information. Incorrect Other DetailsIn cases where you provided inaccurate information other than the TIN, resubmitting a corrected W-9 form for 2023 to download is the way to go. Ensure the updated details are correct before submitting the new copy. Backup WithholdingIf the IRS initiates backup withholding due to an error on your request, you must correct the mistake and inform the requester. To stop backup withholding, provide the requester with a properly completed example and any necessary certifications. Practical Questions on the W-9 Form Answered Where can I find a W-9 form online?You can conveniently download the W9 form for free from our website. Be sure to use the current year's version for compliance. How do I submit a W-9 form?If a business or individual requests a W-9 form from you, they'll typically provide instructions on how and where to submit the completed sample. This can include mailing, faxing, or emailing the copy. Are W-9 forms sent to the IRS?Generally, W-9 forms are not sent to the IRS. The requester keeps them for their records. Payers use these forms to complete informational returns, such as Form 1099, which are then submitted to the IRS. Fill Now